Sellfy vs Payhip: The Better Platform for Digital Creators in 2026

Finding the right platform to sell digital products, memberships, or courses can make or break your online business. This comparison of Sellfy and Payhip will help you decide which platform best supports your content, e-commerce, and passive income goals.

New to digital selling? Be sure to check out our guide to the Best Credit Card Processors by Business Type to ensure your setup is tailored, secure, and conversion-friendly.

In this guide, we break down Sellfy vs Payhip based on real use cases, so you can choose the platform that actually fits how you sell.

What Is the Best Platform to Sell Digital Products?

There’s no single “best” platform for selling digital products—only the best option for your specific goals. The right choice depends on how quickly you want to launch, whether you’re selling courses or downloads, and how much flexibility you need around pricing and payments.

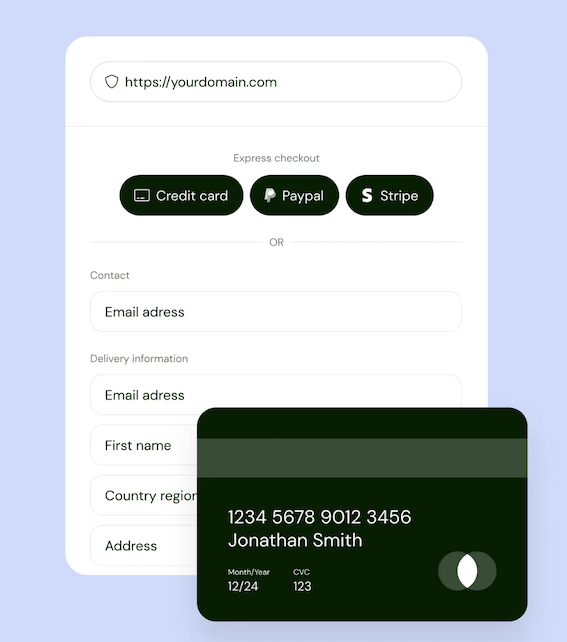

Sellfy is best for creators who want a polished storefront fast. It’s built for speed and simplicity, with built-in marketing tools and a clean checkout experience that works well for digital downloads, subscriptions, and even physical products.

Payhip, on the other hand, is better suited to creators who want flexibility. Its free plan makes it ideal for testing ideas, and its built-in course tools and tax handling are especially useful for educators, coaches, and global sellers.

In short:

Choose Sellfy if you want to launch quickly with a polished storefront and built-in marketing tools.

Choose Payhip if you want pricing flexibility, course delivery features, or a free way to test ideas.

Sellfy: Quick Overview

Sellfy is an intuitive, all-in-one e-commerce platform designed for creators and small businesses selling digital products, subscriptions, and even physical goods. It’s built for simplicity and speed, ideal for solo entrepreneurs and side hustlers.

Key Features

Super simple storefront setup in minutes

Built-in marketing tools like email campaigns, upsells, and discount codes

Embeddable checkout buttons and “buy now” links for external sites or social

Supports digital downloads, subscriptions, physical products, and print-on-demand

Pricing

Starts at $19/month (Starter plan), includes 0% transaction fees

No per-sale fees on premium plans

Best For

Creators, solopreneur, and small businesses seeking an easy-to-launch storefront with digital-first features and strong monetization tools.

Payhip: Quick Overview

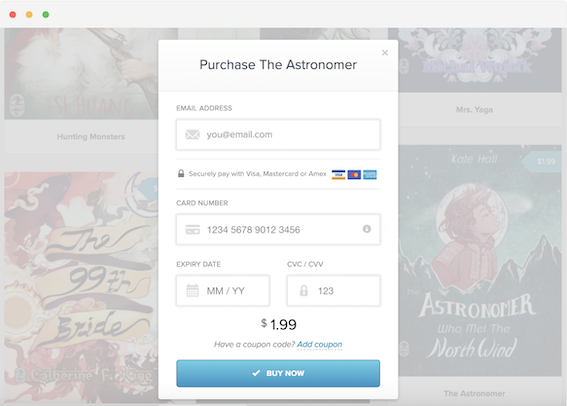

Payhip is another creator-focused platform optimized for selling digital products, online courses, coaching services, and memberships with a zero-monthly-cost entry plan.

Key Features

Free plan with 5% transaction fee - this is great for testing the waters

Powerful tools for pay-what-you-want pricing, coupons, and affiliate programs

Integrated EU VAT handling for global digital product compliance

Course builder with drip content and quizzes (ideal for educators)

Pricing

Free Forever plan: $0/month + 5% transaction fee.

Plus plan: $29/month with 2% transaction fee.

Pro plan: $99/month with 0% transaction fees.

Best For

New creators, educators, and coaches needing flexibility and global tax compliance out-of-the-box with no upfront commitment.

Before signing to a merchant provider, read your go-to 2025 guide to small business card processing.

Sellfy vs Payhip Pricing: Which Is Cheaper Long Term?

At first glance, Payhip looks cheaper because it offers a free plan. However, the long-term cost depends on how much you sell.

Payhip’s free plan charges a transaction fee on every sale, which can quickly add up as volume increases. For creators testing a new product, this is a low-risk way to get started. But once sales grow, those fees can exceed the cost of a flat monthly plan.

Sellfy takes the opposite approach. You pay a fixed monthly fee, but there are no transaction fees on paid plans. This makes Sellfy more predictable and often cheaper for creators who are already generating consistent revenue.

Pricing takeaway:

Low or inconsistent sales → Payhip is cheaper early on

Growing or steady sales → Sellfy is usually cheaper over time

This difference is especially important if you plan to scale or run promotions that drive higher volume.

| Platform | Free Plan | Starting Price (2026) | Transaction Fees |

|---|---|---|---|

| Sellfy | No (trial available) | From $29 / month | 0% on paid plans |

| Payhip | Yes (Free Forever) | $29 / month (paid plans) | 5% (Free) → 0% (Pro) |

Feature Comparison Table

| Feature | Sellfy | Payhip |

|---|---|---|

| Best For | Digital product creators needing simple e-commerce setup | Course creators and digital sellers wanting flexible pricing options |

| Product Support | Digital, physical, subscriptions | Digital products, courses, memberships |

| Course Tools | Basic | Built-in course builder |

| Tax Compliance | Basic EU VAT | EU VAT + U.S. tax handling |

| Checkout Tools | Embeddable links/buttons | Inline checkout |

| SEO Control | Basic via custom domain | Basic via custom domain |

| Pricing (2025) | From $29 / month | Free plan available; paid plans start at $29 / month |

| Free Plan | Yes (limited features) | Yes (basic tools, fees apply) |

Looking to compare a range of Merchant Service providers? Explore our 2025 guide to the Best Credit Card Processors by Business Type breaks down which providers excel across various industries and payment methods

If you’re selling digital products or courses, choosing the right payment provider matters just as much as the platform itself. Our breakdown of the best credit card processors for freelancers and creators covers low-fee options designed for solo sellers and small audiences.

How to Choose: Sellfy or Payhip?

Consider your product type, marketing goals, and technical comfort level:

Quick Start with Digital Storefront:

Choose Sellfy if you want a polished storefront fast, with marketing tools and print-on-demand support.

Experimentation & Flexibility

Choose Payhip if you want a free option to test your digital product ideas, especially with course delivery or coaching.

If your priority is speed and simplicity, Sellfy is the stronger all-in-one choice. If flexibility and course delivery matter more, Payhip offers more room to experiment.

If you’re focused on building your creator business and want the best integrated stack for digital products, courses, and monetization workflows, check out our guide to the best payment platforms for digital creators and course sellers.

ScaleUp Tip

Don’t overbuild.

It’s easy to fall into the trap of trying to perfect every element of your online business before launching custom websites, advanced funnels, automations, branding, analytics, and more. But platforms like Sellfy and Payhip are specifically designed to help you launch quickly with minimal friction. They remove technical barriers, so you can:

Set up a store in under an hour

Start selling with just a product file, a payment method, and a link

Avoid upfront development or integration costs

This "lean launch" model is ideal for creators, coaches, and solo founders who want to validate their ideas fast. Instead of investing time and money into a full tech stack or hiring developers, you can:

Upload your product or offer

Send traffic to your Payhip or Sellfy page

Track conversions and feedback

If your priority is speed, simplicity, and predictable costs, Sellfy is the better all-in-one platform. If flexibility, course delivery, and low-risk experimentation matter more, Payhip is the stronger choice.

Start simple. Validate your offer. Then scale. That’s the sustainable path to monetization.