Stripe vs. Recurly for Subscription Management: Which is Best?

Managing subscriptions effectively is crucial for SaaS and recurring revenue businesses. In this article, we compare two leading subscription management solutions: Stripe and Recurly, helping you choose the best option for your business.

Just starting with payments or need a full-stack solution? Visit our Ultimate Guide to Card Processing for Small Businesses to understand where Stripe and Recurly fit in the bigger picture.

Stripe for Subscription Management: Quick Overview

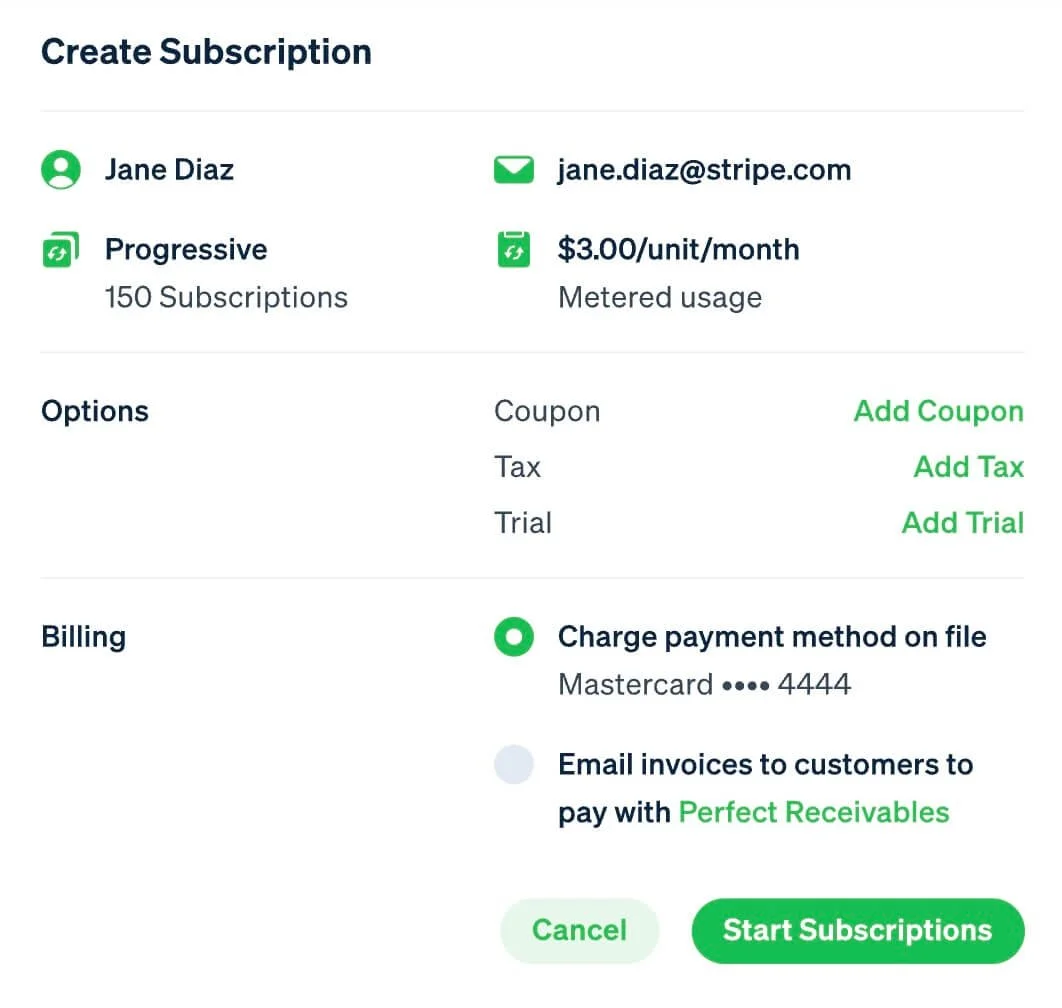

Stripe is widely popular due to its comprehensive suite of payment solutions, including robust subscription management capabilities.

Key Features:

Extensive payment integrations and customizable billing models.

Strong API for custom subscription management.

Global reach with support for multiple currencies and payment methods.

Pricing:

Pay-as-you-go pricing: 2.9% + 30¢ per transaction.

No additional monthly fees for standard subscription management.

Stripe is ideal for tech-savvy businesses requiring customization and scalability.

If you’re running an online store, compare Stripe’s checkout flexibility to e-commerce platforms in our Shopify vs. BigCommerce spotlight comparison.

Recurly for Subscription Management: Quick Overview

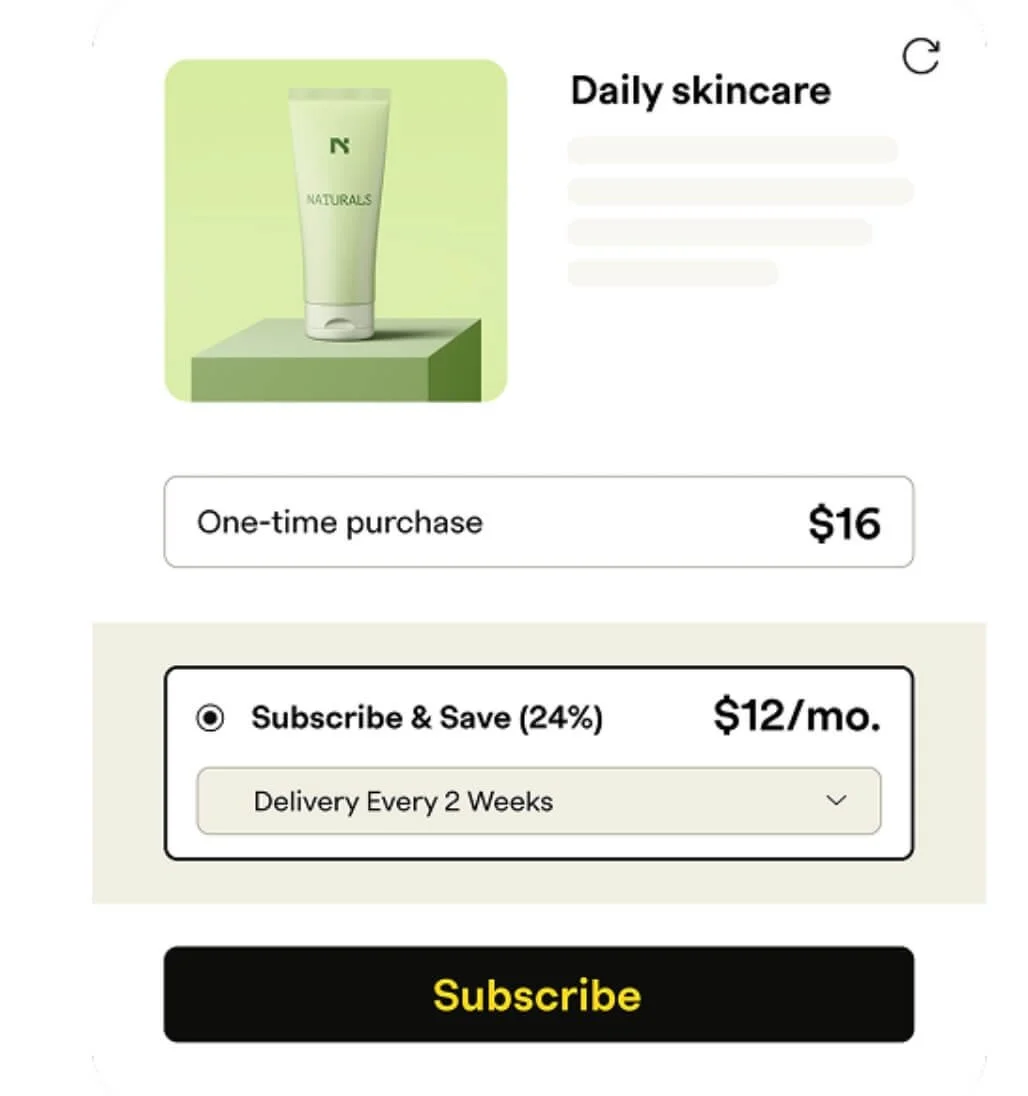

Recurly is specifically built for managing subscriptions, focusing exclusively on delivering a smooth recurring billing experience.

Key Features:

Powerful subscription analytics and revenue recognition tools.

Intuitive subscription management dashboard.

Excellent handling of complex billing cycles and customer retention features.

Pricing:

Plans start from $149 per month plus transaction fees.

Pricing tiers scale based on features and business volume.

Recurly is suited for businesses that prioritize specialized subscription management and sophisticated analytics.

Want to evaluate providers by industry or pricing structure? Head to our Credit Card Processor Comparison by Business Type for insights across e-commerce, SaaS, nonprofits, and more.

| Feature | Stripe | Recurly |

|---|---|---|

| Ideal Use Case | Highly customizable subscriptions | Complex recurring billing needs |

| Subscription Analytics | Good, with basic insights | Excellent, detailed analytics |

| Pricing Model | Transaction-based | Monthly fees + transaction charges |

| Setup Complexity | Moderate (developer-focused) | Easier setup with dedicated UI |

| Global Payment Support | Extensive | Good, but less comprehensive than Stripe |

How to Choose: Stripe or Recurly?

Consider your specific subscription management needs:

Customization and Scalability:

Stripe offers flexibility and extensive customization, ideal for technically capable businesses looking for growth.

Specialized Subscription Management:

Recurly excels at managing complex subscription cycles and delivering advanced analytics for businesses seeking detailed insights.

Curious how these platforms handle broader payment tasks like invoicing, mobile POS, or retail environments? Read our Best Credit Card Processors for Small Businesses for a broader look.

ScaleUp Tip

Identify whether your business needs deep analytics and specialized billing cycles. If so, Recurly may offer an advantage. Alternatively, if global scale and technical customization align with your strategy, Stripe might be your ideal partner. Always align your subscription management platform choice with your strategic growth objectives.